The uncertainty over the future of the American apparel industry intensified after the trade war erupted. Since most clothing retailers depend on Chinese imports to source their materials, the latest round of tariff is bound to impact their businesses negatively. Meanwhile, the reports of a possible trade truce between the US and China have brought some relief to the sector.

The uncertainty over the future of the American apparel industry intensified after the trade war erupted. Since most clothing retailers depend on Chinese imports to source their materials, the latest round of tariff is bound to impact their businesses negatively. Meanwhile, the reports of a possible trade truce between the US and China have brought some relief to the sector.

New Tariffs

There has been a spike in the volume of shipments from China as traders expect the new tariffs to come into effect this month. There will be a similar surge in imports before the next tariff hike, cautiously scheduled for December in order to save Christmas sales. The latest import tax of 15%, announced by the Trump administration for early September and later postponed, will be applicable to textile and footwear products worth $31 billion.

Statistics show that the fresh tariffs would affect around two-thirds of apparels and more than 50% of footwear imported from China. That is something to be worried about as around half of all apparels and footwear sold in the US are imported from China.

Margin Squeeze

The situation does not bode well for the companies as they will have to deal with shrinking margins and store closures as most retailers will be forced to absorb a part of the new tax to tackle competition from online retailers. But, retailers already operating on wafer-thin margins will be left with no other option but to hike prices. It needs to be noted that the primary attraction of China-made products is low prices and cheap labor. Though the government has excluded certain items from the new tariffs, most apparel and footwear categories have found a place in the list of taxable commodities.

Beating the Odds

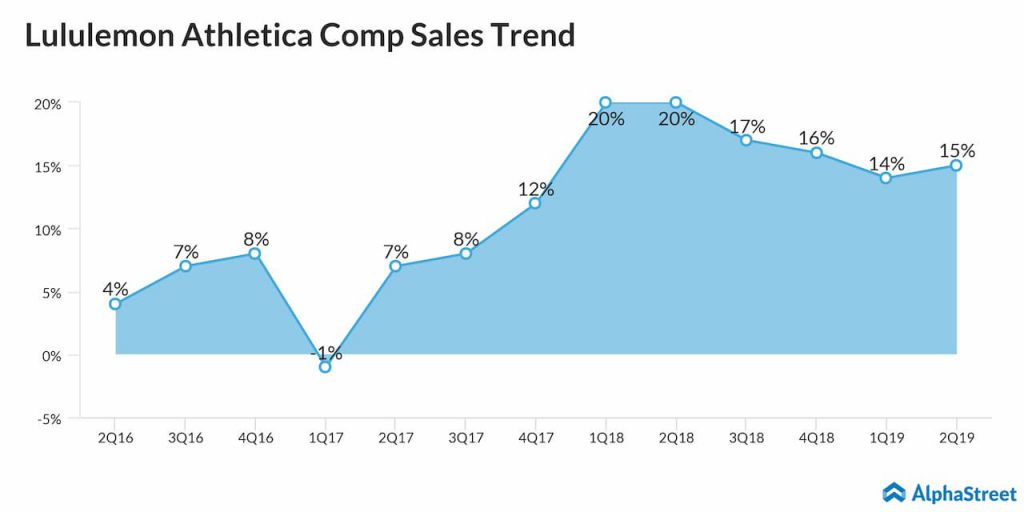

For companies, it is time to revisit their business models. Athleisure retailer Lululemon Athletica (LULU) already have strategies in place to tide over the challenges facing the sector, including the tariff and falling store traffic. The company recently impressed investors with its stellar second-quarter performance, marked by a double-digit comparable sales growth – helped mainly by competitive pricing and the efforts to retain customers thorough promotional activities and community events.

While most of its peers kept a low profile, Lululemon stock climbed to a record high last week, crossing the $200-mark for the first time. With consistent gains, the stock has remained an investors’ favorite over the years and there is enough reason to believe it would retain the status in the near future.

Other Plans

Urban Outfitters (URBN), which came out with mixed results for the most recent quarter, is reportedly planning to dump its Chinese suppliers and source products from other countries while keeping the prices intact. Others like Tailored Brands (TLRD) and Gap, Inc. (GAP) have taken a more moderate stance and started negotiations with their Chinese vendors to share the additional costs through pricing adjustments.

Also see: Tailored Brands Q2 2019 Earnings Call Transcript

The recovery of Urban Outfitters’ stock from its two-year low got a boost last month after it reported positive second-quarter results. However, the price is still relatively low, which justifies the average hold rating on it. In all probability, URBN is on the growth path. Last month, Tailored Brands shares slipped below the $5-mark and hit the lowest level in about 25 years after its dismal guidance spurred a sell-off. The overall performance of the stock calls for caution as far as investment is concerned.

American Eagle Outfitters (AEO), the clothing brand that is particularly popular among teenagers, bets on its unique product pipeline to stay resilient to the trade woes. A potential hike in prices might not dissuade customers from buying their favorite outfits exclusively available at American Eagle stores. Hurt by its dismal comparable sales performance in the second quarter, American Eagle shares slipped to a new low earlier this month. With not many factors working in its favor now, the stock might remain low and stay in the watch-list of long-term investors.

Looming Threat

Market watchers believe that any additional price burden from the China tariffs might discourage a large section of customers from making purchases, which will eat into the margins and profits of the companies.

[“source=alphastreet”]